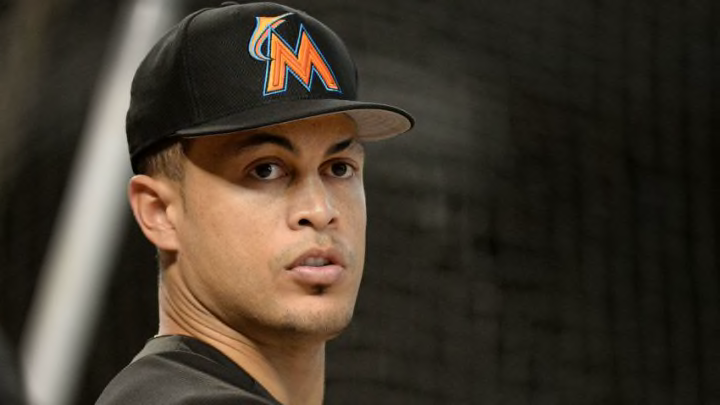

While the Boston Red Sox have their eye on Giancarlo Stanton, the Marlins slugger may consider the MA state income tax before waiving his no trade clause.

The Boston Red Sox are among the teams heavily tied to the Giancarlo Stanton trade rumors, yet a potential deal for the Miami Marlins slugger isn’t without obstacles. One underrated aspect of these trade talks involves taxes.

I’m not referring to MLB’s luxury tax. We’re all aware that taking on Stanton’s massive contract would push the Red Sox into tax territory, an area where ownership has shown a willingness to venture back into next season. What could deter a trade for Stanton is the state income tax.

Stanton’s current team resides in the state of Florida, where there is no state income tax. That means he gets to keep every cent of the $295 million remaining on his contract, which won’t be the case if he’s traded to a team residing in a state that does have income tax.

The Red Sox are among the many teams effected by this. Massachusetts has a 5.1 percent income tax, according to 2017 data provided by TaxFoundation.org. That means that if Stanton were to play out his remaining contract (including the team option in 2028) it would cost him over $15.8 million in taxes. That’s without considering that the state income tax could rise at some point during the duration of his contract.

Stanton is eager to play for a contender, making a Red Sox team starved for the power his bat provides a perfect fit, but is he going to take a $15.8 million pay cut to come here?

More from Red Sox Rumors

- Is Jean Segura the solution to Red Sox’ Trevor Story concerns?

- Red Sox news: Orioles eyeing former Boston arms, Dansby Swanson to Cubs, JD Martinez to Dodgers

- Did Alex Cora just drop a huge hint about Red Sox free-agent target?

- MLB insider hints Red Sox teardown may continue with two trades

- Division rival targeting Red Sox 2022 standout Michael Wacha

This is where the no-trade clause comes in. It’s not that Stanton would necessarily block a trade to Boston. However, he can use that clause in his contract for leverage. If the Red Sox and Marlins were to agree on a deal, Stanton could sign off on the trade contingent on him getting something in return.

Often times these perks to convince a player to waive their no-trade clause come in the form of guaranteeing a future team option. Stanton’s deal has a $25 million team option in 2028 with a $10 million buyout. If Boston agreed to honor that option then it would lock in an extra $15 million for Stanton, offsetting most of the salary lost to income tax.

If Stanton opts out of his deal in 2020 then it would negate any benefit of having his option guaranteed and he will still have paid over $3.9 million in taxes. If he expects to opt out after three years to seek a more lucrative deal at age 30 then he may ask for more incentive beyond guaranteeing his option.

Another perk a team can offer is an assignment bonus as an incentive to waive their no-trade clause. Last year, the Atlanta Braves offered Brandon Phillips a $500,000 assignment bonus as part of negotiations to acquire him from the Cincinnati Reds. The bonus would kick in if the Braves traded him elsewhere, which is what happened at the end of August when he was dealt to the Los Angeles Angels.

Stanton could ask for more than half a million bucks, although the Red Sox won’t pay him a bonus north of $15 million up front to cancel out the income tax concerns. They are unlikely to even approach the $3.9 million he would owe in taxes through 2020 before the potential opt-out. The point is, they’ll have to offer Stanton something. Not enough to hold up a deal but it’s worth noting that the financial cost for acquiring Stanton may be higher than we thought.

The income tax issue could also work in Boston’s favor. The Los Angeles Dodgers and San Francisco Giants are among the other top suitors. If Stanton agreed to be dealt to either team then he would be subjected to California’s staggering 13.3 percent state income tax. That could cost him over $40 million over the course of his deal!

Both teams would have some appeal to the California native but it would be a significant hit to Stanton’s bank account. Those teams could offer Stanton some incentives to appease him but it could cost them a lot more than it would cost Boston due to the tax differential, which could cause them to back down.

The St. Louis Cardinals are in a similar predicament, to a lesser extent. The 6.0 percent state income tax in Missouri is nowhere near what it is in California but it’s still higher than Massachusetts. If all else is equal between the Cardinals and Red Sox then Stanton could lean towards Boston.

Stanton’s no-trade clause gives him the leverage to dictate where he wants to go. There are a limited number of teams that can afford his contract and we know he’ll only accept a trade to a contender. That narrows the list significantly. If the teams the Red Sox are competing with reside in states with higher income tax then it gives Boston an unexpected edge in the Stanton sweepstakes.